Conclusion of Capital Structure

Before a business can turn a profit it must at least generate sufficient. Since the ability to access capital directly affects the value of a business owner-managers need to understand the ramifications of this.

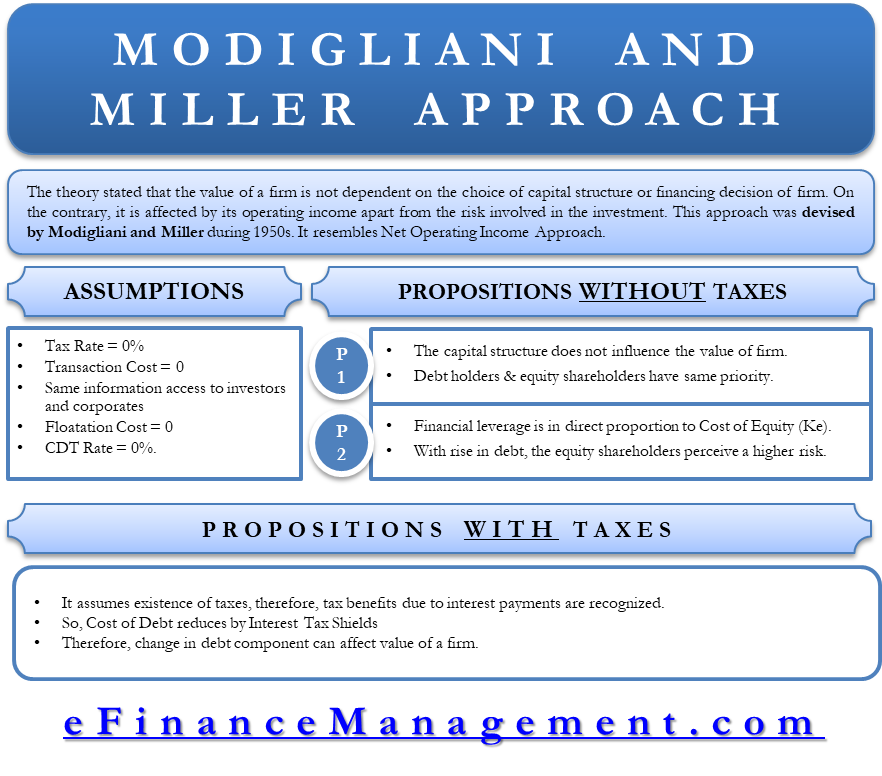

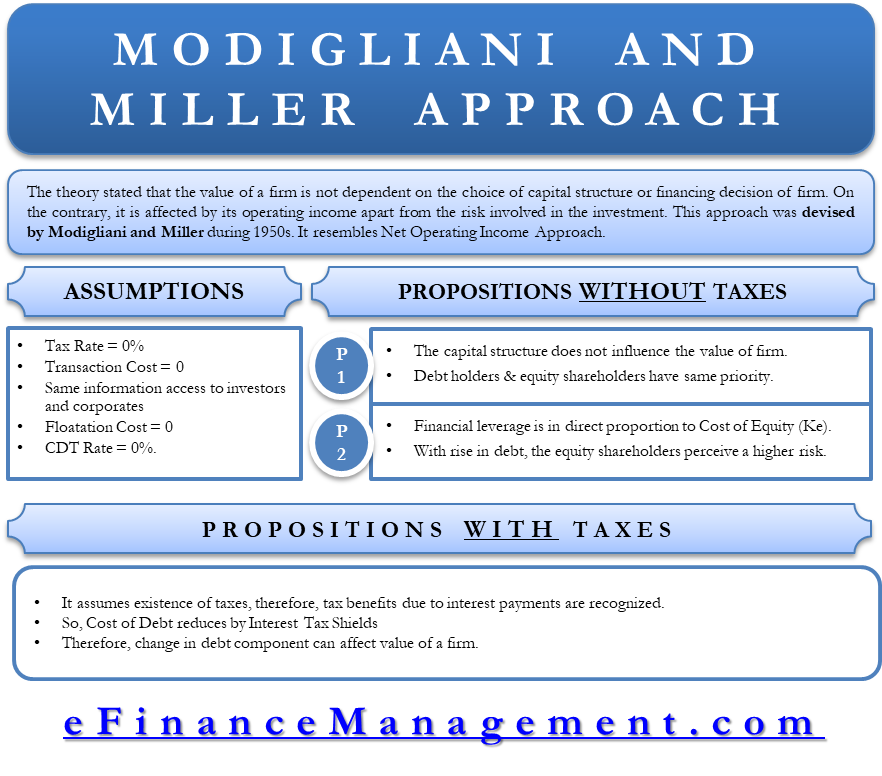

Capital Structure Theory Modigliani And Miller Mm Approach Efm

Capital structure is vital for a firm as it determines the overall stability of a firm.

. Capital structure is a type of funding that supports a companys growth and related assets. Cost of capital is the minimum rate of return that a business must earn before generating value. The basic purpose of this research is to study and to define the factors which have effect on insurance companies profitability.

Here are some of the other factors that highlight the importance of capital structure. It is used to finance its overall operations and. In particular use of equity and debt capital needs.

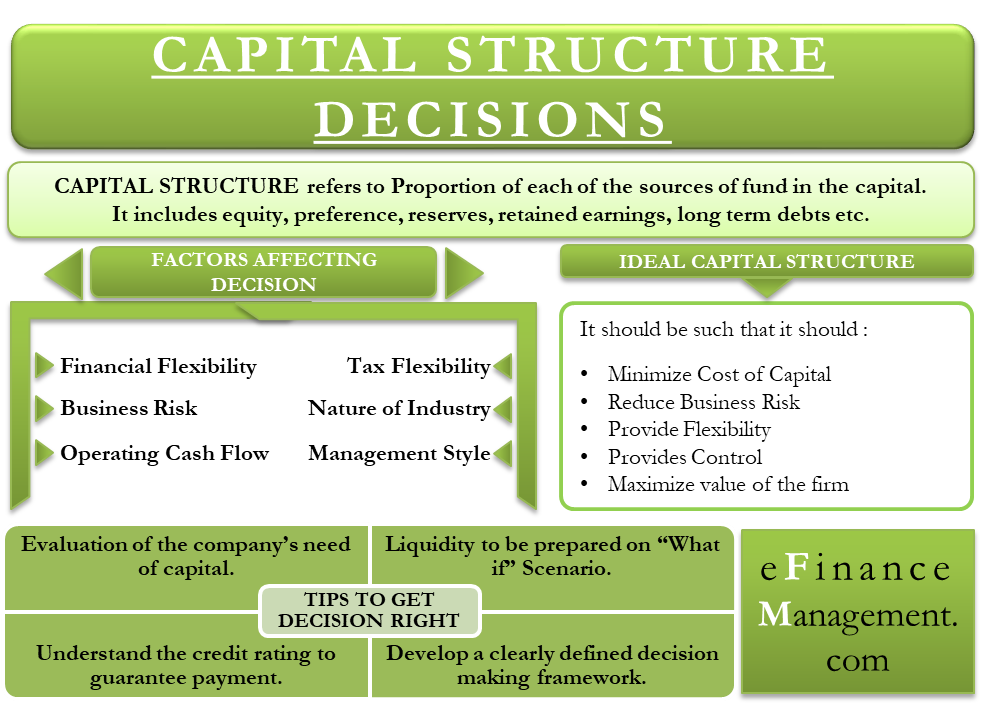

Capital structure is the composition of a companys sources of funds a mix of owners capital equity and loan debt from outsiders. The government-linked firms are known as inefficient firms and they could perform better if they were under private ownership. Capital structure relates to how much moneyor capitalis supporting a business financing its assets and funding its operations.

Many studies report the low performance of state-owned firms. Factors Affecting Capital Structure. A Comparison between Industrial and Consumer Sectors in China Page 31-40 This study examined the different effects of firms.

Other Apps - August 23 2022 Chapter 13 Capital Structure And Leverage Ppt Video Online Download. In this study we. For most of the.

Size of Company -Small companies may have to rely on the founders money but as they grow they will be eligible for long-term financing because larger. 20000 of cash available in the company 40000 of the company bonds should be used and. Capital structure is a very important aspect of a balance sheet as it reflects the financial stability of a company.

A firm having a sound. A projects cost of capital is the minimum expected rate of return the project needs to offer investors to attract money. It directly influences a companys ability to create shareholder value because the balance sheet sets the minimum.

Conclusion In document Determinants of Capital Structure. Up to 3 cash back CONCLUSION. Sometimes its referred to as capitalization structure or simply capitalization.

In document Capital structure corporate cash holding and dividend policy in African countries Page 117-126 This study examined the trends and determinants of. Simply put the cost of capital is the expected rate of return the. Up to 5 cash back Capital Structure.

It can also show company. Target Capital Structure Target capital structure is a function of expected profitability riskiness of operations vulnerabilities to outside constituencies. In designing the capital structure for any firm the first major policy decision facing the firm is that of determining the appropriate level of debt.

The accountants suggested the following capital structure to fund the project. Conclusion of Capital Structure Get link. The choice of capital structure matters to a private company.

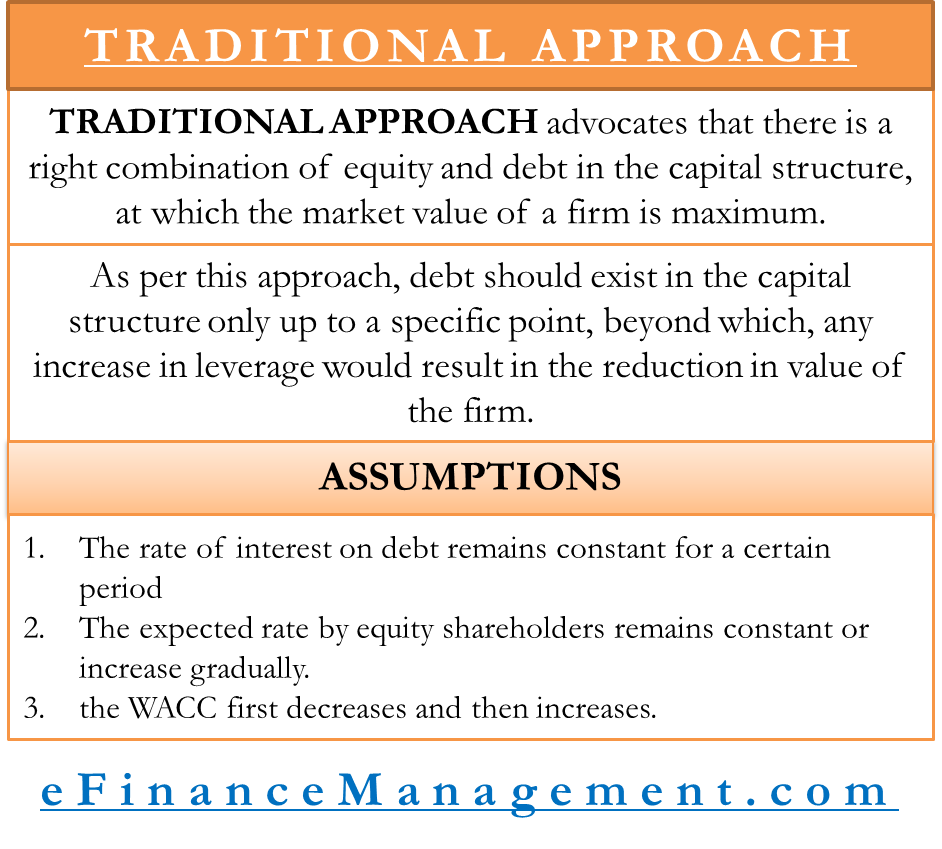

In financial management capital structure theory refers to a systematic approach to financing business activities through a combination of equities and.

Pin By Lizajd21 On Paralegal In 2022 Law School Inspiration Law School Prep Law School Life

Capital Structure Decisions Importance Factors Tips And More

Capital Structure Theory Traditional Approach Efinancemanagement

No comments for "Conclusion of Capital Structure"

Post a Comment